Following up from our previous blog, let’s look at State ModelingTM with the S&P 500 (SPY). Was the big sell-off in December 2018 the bottom of the market for 2019? The markets have been very volatile and the buy/hold strategy has been working since Christmas. Will this trend continue or should trade adjustments and hedges be implemented?

Figure 1. Tracking the SPY from 9/28/2018 to 1/7/2019.

Since the bottom on December 24th 2018, State Modeling has predicted bullish trends on SPY beginning on January 17th when SPY transitioned into a bullish state, State 7. On February 13th, SPY transitioned into a more bullish state, State 5, where it currently remains.

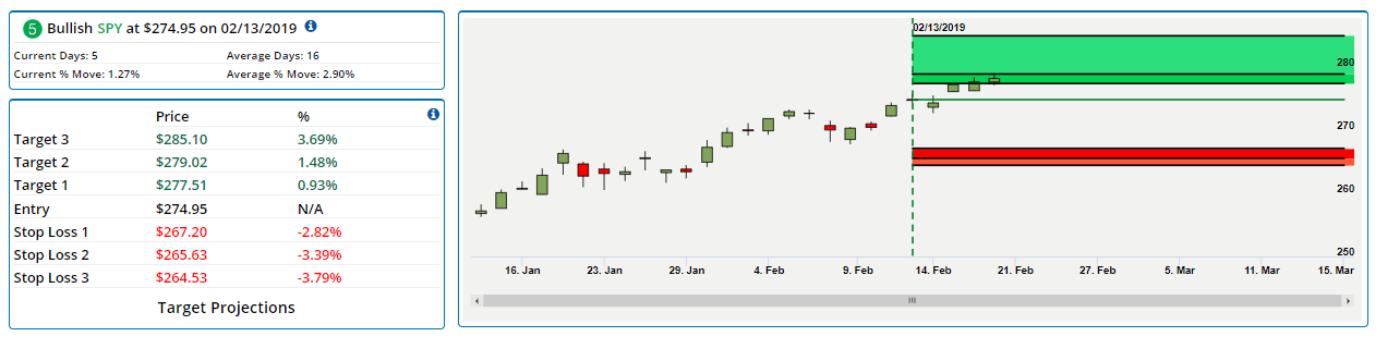

SPY transitioned into State 5 at an entry price of $274.95. Our model generated a series of scenarios and price thresholds for both profit and loss. Profit target 2 at $279.02 (1.48% gain) has been surpassed and this price level is the new bullish support. The next bearish resistance level is Target 3 at $285.10. The expectation is for SPY to move up an average of 2.9% while in State 5 which would be at the price of $282.92. We would look for SPY to hit around this level within the next 8 trading days from the close on February 25, 2019.

Figure 2. Tracking the SPY since it transitioned into State 5 on 2/13/2019.

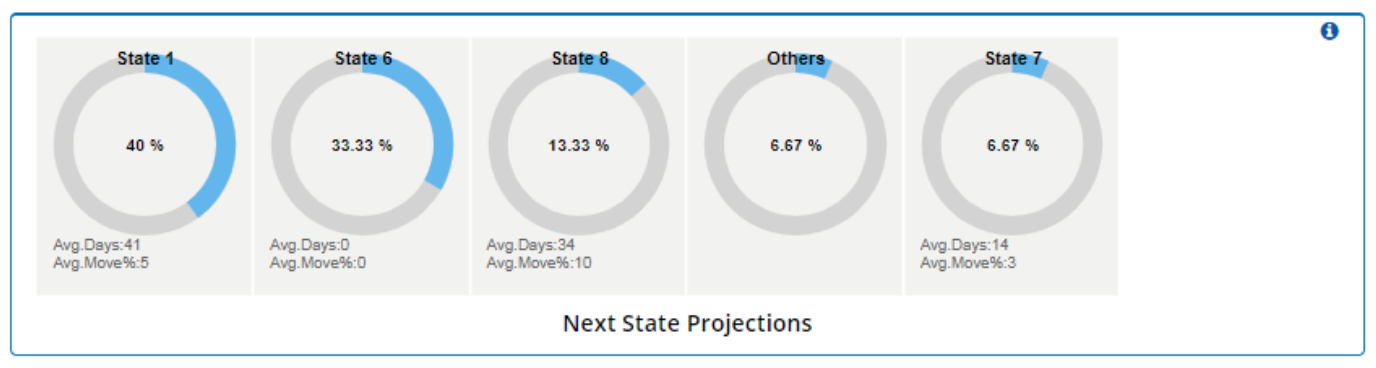

A useful tool within State Modeling is the Next State Projections model. The model analyzes the current state and projects the probability of the next state moving forward. It indicates, based on historical data, the probabilities of a stock continuing or reversing a trend.

The next state projections for SPY in State 5 are shown in Figure 3 below. Bullish states, State 1 and State 7 have probabilities of occurring of 40% and 6.67% respectively. Bearish states, State 6 and State 8 have probabilities of occurring of 33.33% and 13.33% respectively. Since the probabilities of the next state being either bullish or bearish is almost evenly distributed, I would be cautiously optimistic but would have a plan to hedge long positions in the event the market sours.

So to answer the question: Was December the bottom for the Market? From the current position of the market, State Modeling predicts there is a 46.66% chance of the SPY moving lower and only a 13.33% chance that SPY will move into State 8, the most bearish state, where new lows are possible.

Figure 3. Next State Projections for SPY in State 5 on 2/25/2019.