Delphian Trading Launches AI-based Institutional Trading Platform: Data-driven predictive analytics and machine learning-enabled, testable, high-probability strategies

Delphian Trading, a leader in predictive analytics for derivatives trading and incubated by System Soft Technologies, today announced the formal launch of its Delphian Trading platform, which provides institutional-grade, AI-driven predictive analytics and trading strategy design for the creation of high-probability options trading strategies.

Delphian Trading is leaving stealth mode and launching an institutional-grade platform after extensive beta-testing in the retail market and the creation of significant relationships with leading US-based financial organizations.

The platform uniquely allows institutional traders, such as hedge funds and proprietary trading firms, as well as mentors/educators, to identify and test financial trading strategies based on user-chosen parameters. Predictive analytics is built on a decade of intra-day asset pricing, generating machine learning-powered recommendations and decision-making tools. Extensive collaboration tools facilitate idea sharing and online brainstorming.

“We are the first and only FinTech platform on the market to incorporate such extensive trading data analytics, user-defined parameters, and collaboration capabilities, used to identify high-probability strategies that generate alpha,” said Ashok Yarlagadda, founder of Delphian Trading. “Our team of experts drew on their decades of cumulative trading experience to design a platform that overcomes entrenched limitations of legacy approaches, and we have validated this in the market.”

“Our strategy design and State Modeling capabilities have already demonstrated significant consumer adoption and we're now offering our model to educators and institutional traders across a broad spectrum of financial firms.”

State Modeling

Financial and market data volumes have become overwhelming for individuals and legacy systems, and many models can't process and incorporate all data into a fully-informed trading strategy. Delphian Trading’s proprietary State Modeling uses machine learning quantitative mathematics to analyze huge datasets, identify patterns, and correlate them to probable future outcomes, creating data-driven objective analytics to support any number of customized trading strategies.

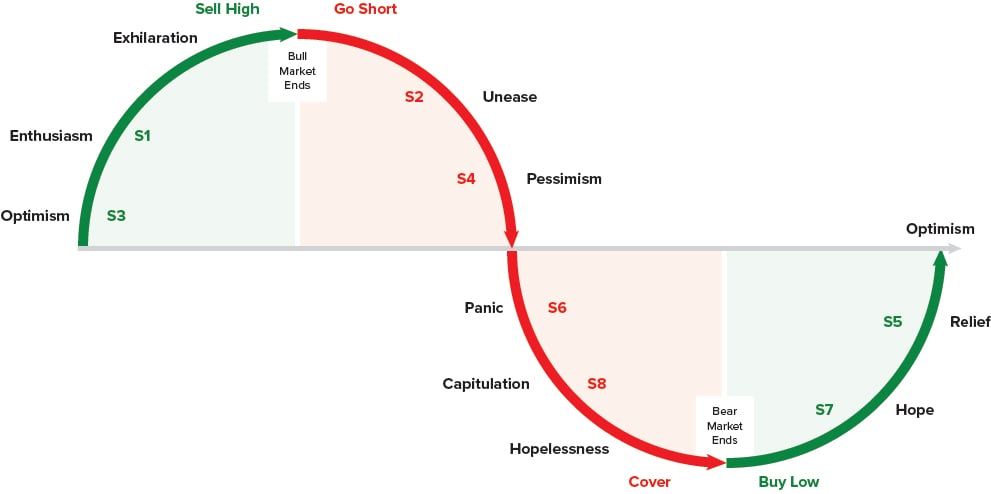

State Modeling assigns each underlying asset to one of eight states, from bearish to bullish, enabling users to quickly identify the assets around which trading strategies should be tested.

Strategy Design

Delphian Trading’s platform enables a comprehensive structuring and testing of trading strategies to help drive higher returns. Delphian Studies are a library of predefined strategies around a variety of conditions. Backtesting derivatives in the platform then helps evaluate trading ideas by incorporating a large set of trader-defined parameters into an analysis of how specific trades would have performed over a certain period of time, based on over a decade of historical, intra-day pricing data.

Strategy design and backtesting results enable traders and mentors to build high-probability strategies and then share them with colleagues, clients, and students, using collaboration tools and real-English system-generated reports.

Learn more about the Delphian Trading platform, watch our explainer video, and read our company blog. Listen to our podcast, “A Roadmap To Massive Profits” in conjunction with Agora Financial and the Seven Figure Podcast: https://apple.co/2LRYO1o

Media contacts

Eric Thacker, System Soft Technologies

eric.thacker@sstech.us

+1 408 499 9161

Simon Marshall, Waters Communications

simon@waterscomms.com

+1 307 439 9000