Profiting from Options Trading During Earnings Season

It’s that time again…. Earnings season is upon us. The stock market has made a nice move this year, but has slowed quite a bit? Is it a peak or a lull?

Either way, some stocks have stood the test of time and historically reported consistent profits during earnings.

One of them, IRobot Corporation (IRBT), will release earnings on April 23, 2019, after market close (AMC). This stock has been performing very well since January 3, 2019. The closing price on January 3rd was $78.28 and the closing price on April 17th was $129.16. After such a big move in a short period of time, many traders might consider this a risky investment on a price basis. Some may take this opportunity to be a contrarian and place a bearish bet. However, when IRBT is analyzed and backtested around its earnings release, an entirely new trade idea comes to light.

IRBT was backtested using the Delphian criteria for a bullish runner strategy. A bullish runner is a stock that has consistently displayed a significant price increase after the earnings announcement. After this criteria was met, IRBT was tested for further probability and profitability using a variety of stock and option trading strategies. This versatile testing and optimization is key in developing a consistently profitable trading strategy.

Using the bullish runner strategy and a long position, IRBT has produced a profit 9 out of the past 10 earnings releases. The trade is buying a call option with at least 45 days until expiration and at minimum a 25 delta. The position will be entered on IRBT the day after earnings, April 24, 2019 and hold the position for a 50% profit, 100% stop loss or exit after 20 trading days, whichever comes first.

.

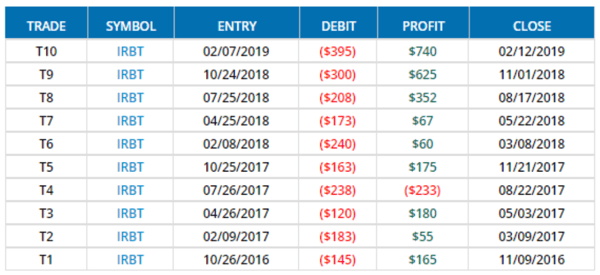

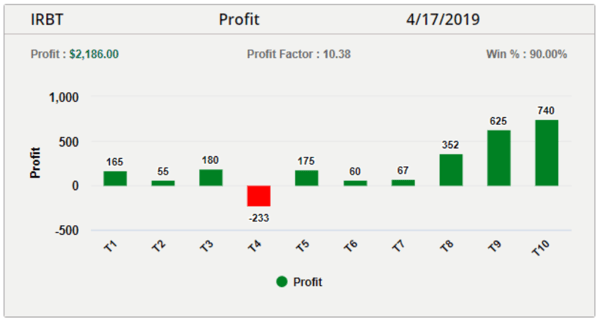

The past 10 trade results are noted in the two graphics below.

Figure 1. IRBT trade results table

Figure 1. IRBT trade results table

Figure 2. IRBT trade results graph

Figure 2. IRBT trade results graph

With a 90% win rate and a cumulative profit of $2,186 from an average risk per trade of only $216.50, this has been a highly probable and profitable trade.

IRobot is one of the many stocks that meet this specific criterion. Finding these types of trades without the proper tools can be a difficult, if not impossible. But with our Delphian platform and optional help from our trading strategists, you can finding highly probable earnings trades like IRBT. You can also explore other trading strategies beyond those based on earnings announcements.