What type of Options Trader are you?

In options trading there are two types of traders: Directional traders and Volatility traders.

What does it mean? In short, if you are a directional options trader, you are basing your buys/sell decisions on the price direction of the underlying stock or index. A person who buys and sell stocks are also considered directional traders. Directional trading is the most common trading in the markets. You have two basic possibilities. You can speculate on an increase in an asset’s price – in this case you say you are bullish. Or you can speculate on a fall in an asset’s price and you say you are bearish. If you are a volatility trader, you are selling options to directional traders. Volatility traders want to sell options when they are overvalued. We will discuss how we know whether an option is overpriced later!

Stock pricing is cut and dry. The price of XYZ is $50 a share. Option pricing is a little more complicated. The primary drivers of the price of an option: current stock price, intrinsic value, extrinsic value (time to expiration or time value, and volatility). The current stock price is fairly obvious. The movement of the price of the stock up or down has a direct - although not equal - effect on the price of the option. As the price of a stock rises, the more likely the price of a call option will rise and the price of a put option will fall. If the stock price goes down, then the reverse will most likely happen to the price of the calls and puts.

As we noted, options prices are comprised of intrinsic value and extrinsic value. Intrinsic value is how much the option is worth regardless of other factors (extrinsic value). If you have a $25 call option and the price of the stock is $30, then you have $5 of intrinsic value. Extrinsic value is comprised of time and volatility. Option contracts have a specified time period. The shorter the duration of the option, the less that will be charged. The second component of extrinsic value is volatility. Every quarter, companies come out with earnings. This creates uncertainty because it is unknown what the company will announce. Because of this, option sellers raise the price of options due to the possible news associated with their earnings announcement.

Think of options as insurance. If I sell you car insurance for one day, it will be cheaper than for a whole year. Why, because you have a shorter period of time in which an accident can occur. As for the volatility aspect, the car insurance company charges more for a sports car than a minivan. The sports car goes faster and therefore is considered more likely to get in an accident and therefore more volatile.

Three economist created a mathematical formula called the Black-Sholes model for determining a theoretical value for option. Option prices can be priced higher or lower than theoretical value. In times of unrest, option sellers will raise the cost of options so high, that it is nearly impossible to make money buying options.

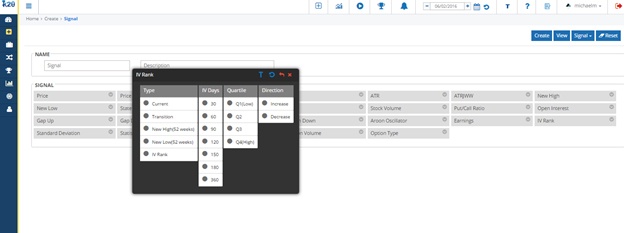

With our Key2Options Platform, we can scan for stocks that have high implied volatility (expensive) or that have low volatility (inexpensive). When Options are expensive, we want to be sellers of options (Volatility trader). When options are inexpensive during times of low volatility, we want to be buyers of options (directional trader).

Sometimes it’s better to be a directional trader, sometimes a volatility trader. It just depends whether the option is under or overpriced. Learn how to trade both ways with the Key2Options platform.

Always remember to Plan your Trade and Trade your Plan with Key2Options.