Hedging Your Portfolio

With the markets at frothy nosebleed levels, we have been asked about how to hedge your portfolio in the event of a market correction. Long term investors may have tax consequences to consider so they look to hedge their positions with options. Investors who believe there could be a correction or Black Swan event in the coming future may design a hedge with options to reduce the effect of an event.

Options are a great tool for protecting your portfolio. With any insurance, there are questions to be answered before deciding on the proper amount of insurance. Do I want to protect the entire portfolio or just a portion of it? What is the composition of my portfolio? How long do I want protection?

Why Hedge?

1987, 2001, 2008. If you lived through the markets during those years, you already know what can happen.

What goes up, must come down…at some point. Like death and taxes, market corrections are part of life. Using options to protect your portfolio is costly, but allows one sleep like a baby at night. Let’s take a look at how we can hedge a portfolio with options.

Hedging 101

When purchasing put options, you will want to pick an index that has a similar beta to your portfolio. The S&P has a 1.0 beta. A beta of less than 1 means that the security is theoretically less volatile than the market. A beta of greater than 1 indicates that the security's price is theoretically more volatile than the market.

The SPY is best for a diversified portfolio of larger cap stocks. Those who own mostly small cap stocks might consider using the IWM, while the QQQQ would match up well with a portfolio made up mostly of tech stocks. All three of these ETFs are heavily traded and have very liquid options markets.

Let’s assume your portfolio is correlated to the S&P index. We will use the SPY options for our hedge.

To determine how many contracts we need to hedge, we will use the formula below.

Portfolio Value: $100,000

Underlying Value of 1 SPY Option Contract:

$218 x 100 = $21,800

Contracts Needed to Fully Hedge Portfolio:

$100,000 / $21,800 = 4.58 Contracts

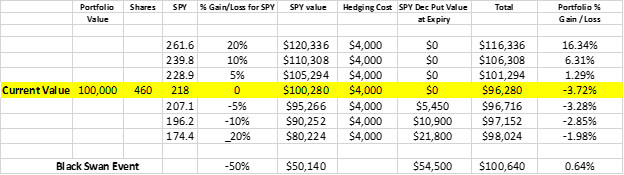

We will round up the options to 5 to be safe. The current price for the At the Money SPY 218 put strike with December expiration is $8.00. The cost of your hedge would be $8*5*100 which equals $4,000 or 4% of your portfolio.

If your $100,000 shares were in SPY, you would own approximately 460 shares. We will look at some different scenarios.

Summary

This is a general hedging strategy for those who may be concern about upcoming volatility. Yes, you will be giving up some upside if the market rallies, but that is the nature of a hedge. A hedge is essentially an insurance policy for your portfolio and whether or not you decide to hedge your own portfolio will depend on your specific market outlook and risk tolerance.