Common Mistakes When Trading Options

Hi, my name is Michael McNelis and I am an Options Strategist with Key2Options. I want to share some of the common mistakes I see options traders make so that you can accelerate your learning curve and become a profitable trader.

As with most endeavors, we learn things by making mistakes. Options trading is no different. Let’s take a look at some of the most common mistakes I see in options trading and how you can avoid them.

- Not having a plan

- Buying options with too short of a duration.

- No understanding of implied volatility

- Failing to Diversify Strategies

Not having a plan - One of the Mantras at Key2Options is plan the trade and trade the plan. Prior to entering a trade, we review 10 years of historical trades to find optimal trading parameters for the strategy you have chosen. Prior to entering into a trade, we know how we will manage the trade if the market moves higher, moves lower or stays the same level. With Key2Options, we help you make rational trades not emotional trades.

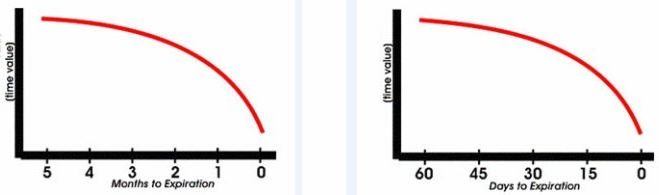

Buying options with short duration - A trap that many beginning traders get into is buying options with short term expirations. It would be great if we bought and option and the underlying did exactly what we wanted it to do, however, this is rarely the case. The allure of an inexpensive option with short expiration periods entices new traders in hopes of huge payoffs. There are 2 reasons why we want to buy options with expiration of a minimum of 60 days. First, we may not be as precise as we hoped when entering the position. Time gives us the ability to be correct. The second reason to buy options with longer duration is because of time decay. Each day an option loses value. As a buyer of options, this is bad news. Options don’t decay at the same rate. Options within the last 30 days of expiration erode significantly faster.

No understanding of implied volatility - One major problem trader’s face when trading options is not understanding the implications of implied volatility. To understand implied volatility, we must also know what historical volatility means.

Implied Volatility vs. Historical Volatility

Historical volatility looks to the past to see how volatile a stock has been over a given period of time. Implied Volatility implies what the expected volatility will be in the future.

How to Find Implied Volatility

Volatility is risk, both to the long side and the short side. Option trading gives you a way to avoid that risk, but for a price. That price, set by the market, is where we find our implied volatility. Here's the breakdown of an option price: The intrinsic value is the component of option pricing that is the relationship between the strike price of the option and the price of the underlying stock. It tells you how advantageous it is to exercise the option at expiration. The extrinsic value is the value that's left over. It is the "excess" value that is also known as the "risk premium" of the option. We can break down the extrinsic value even further to two components: The extrinsic value has two components of risk: time risk and volatility risk. The time risk is related to how many days are left between expiration and the current date. The volatility risk is what's known as the implied volatility. This value tells us what the options market is expecting in terms of price movement outside of the trend.

Failing to Diversify Strategies - If we think the market is headed higher and we put all our chips on the table, if we are wrong, we will lose it all. The best thing about options trading is that: options give you options. We might want to buy some out right calls but also puts at the same time in case we are wrong. Not only are options for directional trading but we can also trade options to bring in income. Whether it be for capital appreciation or for hedging current positions, option trading should be utilized with different strategies to profit from different scenarios.